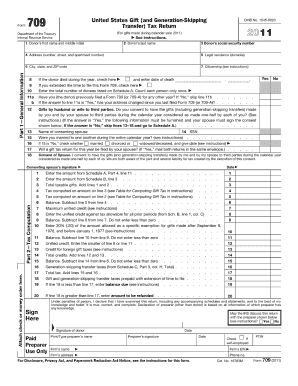

NY DTF PT-102.4 2011-2025 free printable template

Show details

4 9/11 Read instructions Form PT-102-I carefully. Keep a copy of this completed form for your records. Page 2 of 2 PT-102. 4 9/11 EIN 1 Total gallons. 1 2 Gallons of non-highway B20 enter here and on Form PT-102 line 36. New York State Department of Taxation and Finance Diesel Motor Fuel Taxable Sales or Use Sales to Manufacturers for Use in Manufacturing and Sales to Railroads for Use as Railroad Diesel PT-102. Name of distributor Part Federal employer identification number EIN Month/year 1...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pt102 4 form

Edit your pt form use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 11 partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales tax vehicle online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ein pt form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales taxable form

How to fill out NY DTF PT-102.4

01

Obtain Form NY DTF PT-102.4 from the New York State Department of Taxation and Finance website or your local tax office.

02

Start by filling out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your tax year for which you are filing the form.

04

Provide information regarding your income, including wages, self-employment income, and any other sources.

05

Fill out deductions and credits that you are eligible for, ensuring you have documentation for each.

06

Calculate your total tax liability based on the information provided.

07

Review all entered information for accuracy and completeness.

08

Sign and date the form at the bottom before submitting it to the appropriate tax authority.

Who needs NY DTF PT-102.4?

01

Individuals or businesses that are subject to New York State taxes and need to report their tax information.

02

Taxpayers who are applying for refunds or credits related to their taxes in New York.

03

Those who have received a notice from the New York State Department of Taxation and Finance requiring the completion of this form.

Fill

number pt form

: Try Risk Free

People Also Ask about pt city form

What do you need to pay sales tax on a car in Missouri?

You Will Pay: State sales tax of 4.225 percent, plus your local sales tax Document on the purchase price, less trade-in allowance, if any; $8.50 title fee; Registration (license plate) fees, based on either taxable horsepower or vehicle weight; $6 title processing fee; and.

How do I pay sales tax for a small business in Missouri?

You typically pay most of your state business taxes to the Department of Revenue. You can pay many of your taxes through the Department of Revenue's MyTax Missouri online portal. If you need to pay unemployment taxes, you'll pay the Department of Labor and Industrial Relations.

Do I need to file sales tax in Missouri?

A seller not engaged in business is not required to collect Missouri tax but the purchaser in these instances is responsible for remitting use tax to Missouri. A purchaser is required to file a use tax return if the cumulative purchases subject to use tax exceed two thousand dollars in a calendar year.

What happens if you don t pay sales tax on a car in Missouri?

Missouri's criminal failure to pay sales tax penalty is an up to $10,000 fine and/or imprisonment for up to 5 years.

How long do you have to pay sales tax on a car in Missouri?

You have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. If you do not title the vehicle within 30 days, there is a title penalty of $25 on the 31st day after purchase. The penalty increases another $25 for every 30 days you are late with a maximum penalty of $200.

How do I file sales tax in Missouri?

You have three options for filing and paying your Missouri sales tax: File online – File online at the Missouri Department of Revenue. File by mail – You can use Form 53-1 and file and pay through the mail. AutoFile – Let TaxJar automate your sales tax filing and remittance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in taxable liability without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax taxable, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my sales tax taxable in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your liability partnership and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out particular partnership using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign taxable partnership and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NY DTF PT-102.4?

NY DTF PT-102.4 is a tax form used in New York State for reporting certain tax information related to personal income.

Who is required to file NY DTF PT-102.4?

Individuals or entities that have received income subject to withholding or are claiming a tax credit must file NY DTF PT-102.4.

How to fill out NY DTF PT-102.4?

To fill out NY DTF PT-102.4, taxpayers should provide their personal information, reporting details of income, and any applicable deductions or credits as specified in the instructions.

What is the purpose of NY DTF PT-102.4?

The purpose of NY DTF PT-102.4 is to facilitate the reporting of income and related tax information accurately to ensure compliance with New York tax laws.

What information must be reported on NY DTF PT-102.4?

Information that must be reported includes personal identification details, income amounts, withholding details, and any deductions or credits applicable.

Fill out your NY DTF PT-1024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Taxable Partnership is not the form you're looking for?Search for another form here.

Keywords relevant to corporations liability

Related to taxable corporations

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.